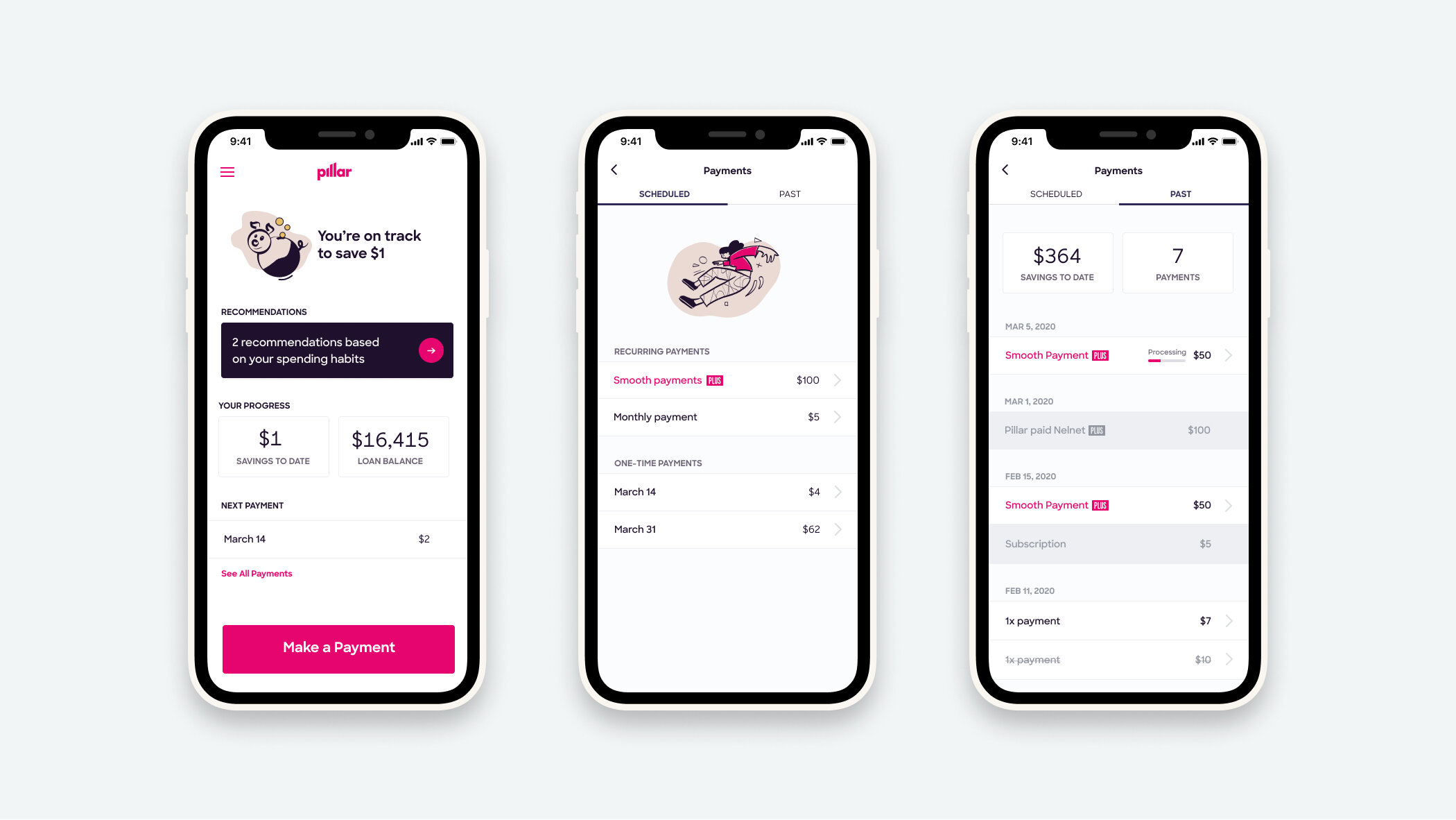

Winning trust through the Pillar payment interface

Making and managing payments was at the core of the Pillar app, and so our interface needed to give users the confidence that Pillar could successfully transfer money from their bank account to their loan servicer.

Users stated trust as one of the biggest barriers to making recurring payments. To increase trust, we wanted to make sure they had easy access to money movement. The overview page reminds them of their next payment, as well as gives them access to all future and past payments.

After seeing a spike in customer service emails related to payment processing, I worked with my team to add a progress bar to the payments detail page. Now, users can see where their money is in the process of moving from their bank account to their student loan...and not one email about payment processing since!

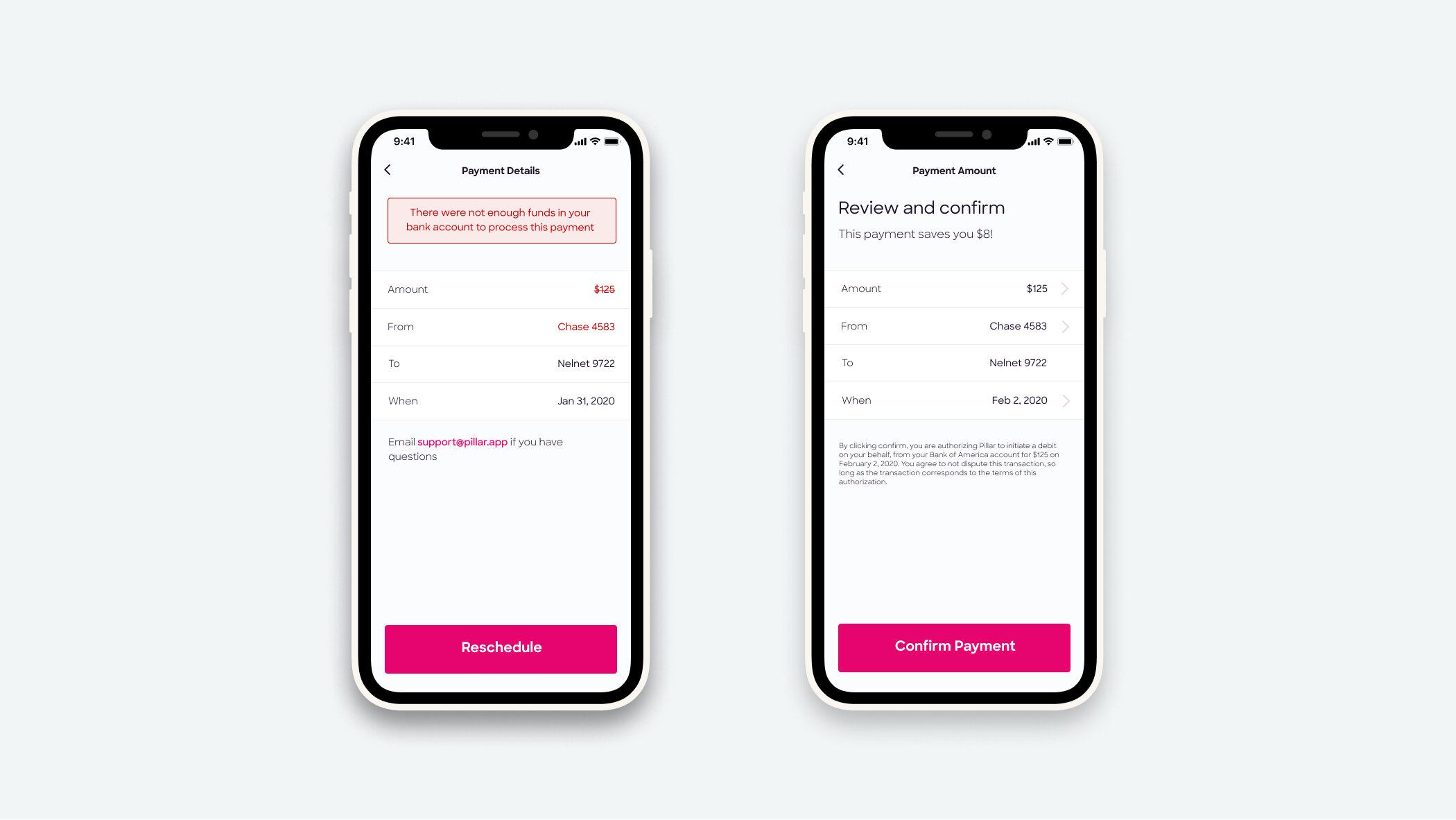

A user is able to delete any payment before it starts processing. While a simple concept with one-time payments, we needed to add an extra layer of design onto recurring payments to ensure that we were 1) effectively communicating what the app could do and 2) making sure the user felt that they still had control to cancel future payments.

We made it easy to address a payment error.

We gave clear feedback that a user’s action had been successful.

More Case Studies

-

Accelerating therapist onboarding at UpLift

-

The importance of talking to your users

-

Getting internal buy-in to streamline onboarding